| MERCADOLIBRE, INC. (Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):Name of Registrant as Specified In Its Charter)

| ☑

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | ☒ | | | No fee required. | | ☐ | | | Fee paid previously with preliminary materials. | | | ☐ | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

TABLE OF CONTENTS Table of Contents | | | | | (1)

| Title of each class of securities to which transaction applies:

| | | (2)

| Aggregate number of securities to which transaction applies:

| | | (3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| | | (4)

| Proposed maximum aggregate value of transaction:

| | | (5)

| Total fee paid:

| | ☐

| Fee paid previously with preliminary materials.

| | | ☐

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | | | (1)

| Amount Previously Paid:

| | | (2)

| Form, Schedule or Registration Statement No.:

| | | (3)

| Filing Party:

| | | (4)

| Date Filed:

| | | | | | | | | | | | | | | | | | | | | | | | | |

TABLE OF CONTENTS

April 29, 2021

Dear Stockholder:

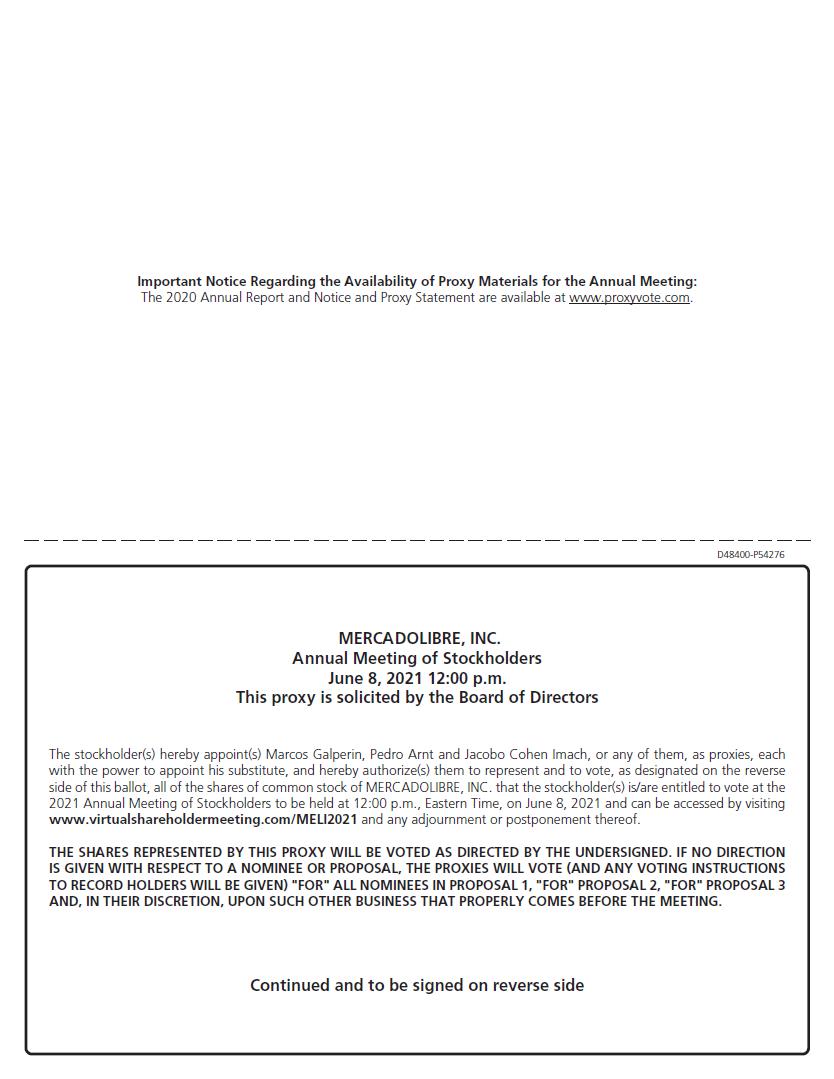

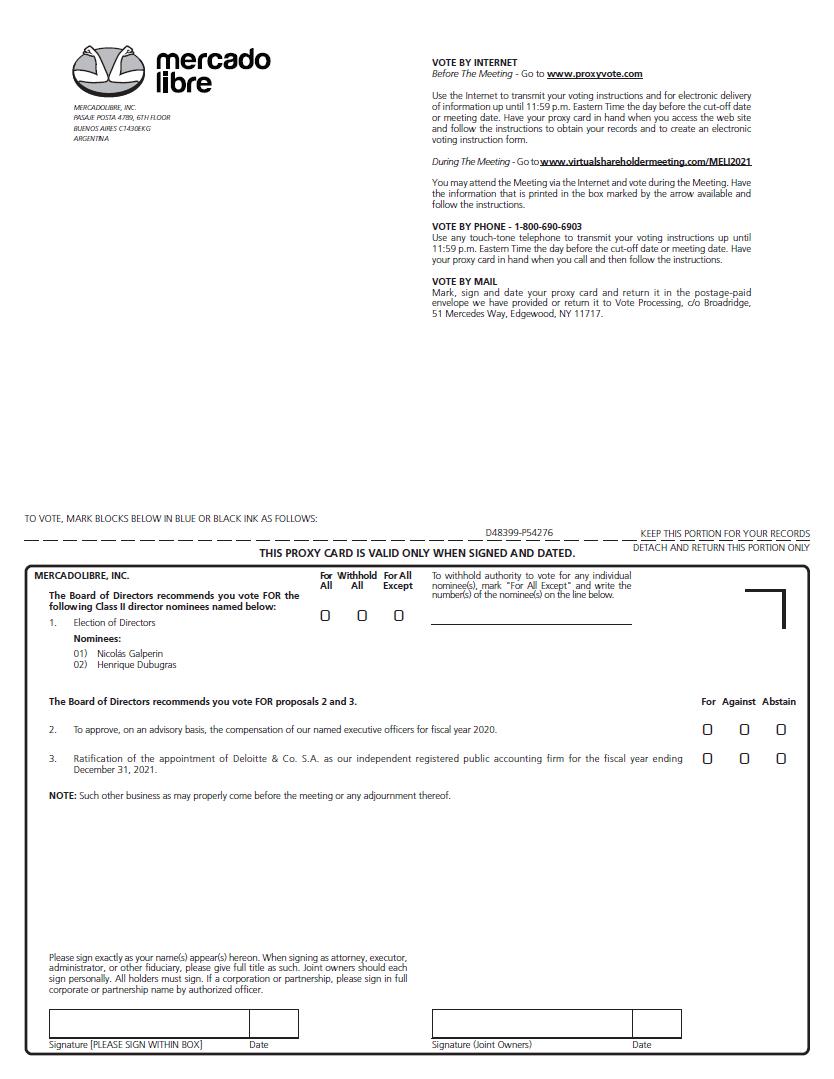

You are cordially invited to attend the 2021 Annual Meeting of Stockholders of MercadoLibre, Inc., which will be held virtually at 12:00 p.m., Eastern Time, on Tuesday, June 8, 2021. You will be able to attend the 2021 Annual Meeting vote, and submit your questions during the meeting via the Internet by visiting www.virtualshareholdermeeting.com/MELI2021.

We are pleased to use the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials to their stockholders primarily over the Internet. We believe that this electronic process should expedite your receipt of our proxy materials, lower the costs of our Annual Meeting and help to conserve natural resources. On or about April 29, 2021, we first mailed to our stockholders a Notice of Internet Availability containing instructions on how to access our 2021 Proxy Statement and 2020 Annual Report and how to vote. The notice also included instructions on how to receive a paper copy of our proxy materials, including the proxy statement, proxy card and 2020 Annual Report.

2020 marked a turning point on a global scale. We have all been living moments of uncertainty, with unexpected changes and great challenges. In this context, MercadoLibre became an essential service and had to ensure that many important contributions to people’s lives arrived through our services. We assumed this unique and privileged position with great responsibility. We did this also with a focus on strengthening our purpose; democratizing commerce and financial services to transform the lives of millions of people in Latin America. Today more than ever, we know that the world needs transformation. That is why we want to be better every day, taking into account the growth of our business and its environmental impact and social role.

On behalf of the board of directors, I would like to express our appreciation for your continued interest in MercadoLibre. We look forward to your attendance at the 2021 Annual Meeting of Stockholders or receiving your proxy vote.

Sincerely yours,

Marcos Galperin

Chairman of the Board, President and Chief Executive Officer

| | MercadoLibre 2021 Proxy Statement

| 3

|

Notice of Annual Meeting of Stockholders

to be held on June 8, 2021

Meeting information

| | |

| The 2021 Annual Meeting of Stockholders of MercadoLibre, Inc. (the “2021 Annual Meeting”) willto be held on June 5, 2024

|

DATE & TIME | | | LOCATION | | | RECORD DATE | Wednesday, June 5, 2024

at 12:1:00 p.m.,p.m, Eastern Time on June 8, 2021. | | |

| The Annual Meeting can be accessed by visiting

| www.virtualshareholdermeeting.com/MELI2021,MELI2024, where stockholders will be

able to listen to the meeting live, submit questions and vote online. | | | April 9, 2024 |

Items of business: | |

| Items of business:

| | | 111 | | | To elect the twonominees for Class II directors nominated and recommended by our board of directors, each to serve until the 20242027 Annual Meeting of Stockholders, or until such time as their respective successors are elected and qualified; | | | | | | 121

| | | To approve, on an advisory basis, the compensation of our named executive officers for fiscal year 2020;2023; | | | | | | 131

| | | To ratify the appointment of DeloittePistrelli, Henry Martin y Asociados S.R.L., a member firm of Ernst & Co. S.A.Young Global Limited, as our independent registered public accounting firm for the fiscal year ending December 31, 2021;2024; and | | | | | | 141

| | | To transact such other business as may properly come before the meeting. | | |

| Record date

| | Our board of directors has fixed the close of business on April 12, 2021 as the record date for determining the stockholders entitled to notice of and to vote at the 2021 Annual Meeting. Only stockholders of record as of the close of business on April 12, 2021 are entitled to notice of and to vote at the 2021 Annual Meeting and at any adjournment or postponement thereof. We ask that as promptly as possible you vote via the Internet, by telephone or, if you requested to receive printed proxy materials, by mailing a proxy card or voting instruction card.

|

Whether or not you plan to attend the meeting, please read our 20212024 Proxy Statement for important information on each of the proposals, and our practices in the areas of corporate governance and executive compensation. Our 20202023 Annual Report to Stockholders on Form 10-K for the year ended December 31, 2023 (“2023 Annual Report”) contains information about MercadoLibre, Inc. (the “Company”“Company” or “MercadoLibre”) and our financial performance. Voting on the Internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated. Using the Internet or telephone saves us money by reducing postage and proxy tabulation costs. Please provide your voting instructions by the Internet, telephone, or by returning a proxy card or voting instruction card. | | By order of the board of directors, /s/

| Jacobo Cohen Imach Jacobo Cohen Imach

Sr. Vice President,

General Counsel and Secretary | | | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 20212024 ANNUAL MEETING. THE NOTICE OF MEETING AND PROXY STATEMENT FOR THE 2021 ANNUAL MEETING AND OUR 2020 ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE ELECTRONICALLY AT www.proxyvote.com. | | MercadoLibre 2021 Proxy Statement

| 4

|

TABLE OF CONTENTS

| | MercadoLibre 2021 Proxy Statement

| 5

|

PROXY STATEMENT

INTERNET AVAILABILITY OF PROXY

MATERIALS

Under U.S. SecuritiesThe notice of meeting and Exchange Commission (“SEC”) rules, weproxy statement for the 2024 annual meeting and our 2023 Annual Report are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder.available electronically at www.proxyvote.com. On or about April 29, 2021,25, 2024, we first mailed to our stockholders (other than those who previously requested electronic or paper delivery of the proxy statement) a Notice of Internet Availability containing instructions on how to access our proxy materials, including our proxy statement and our 2023 Annual ReportReport.

| | | MercadoLibre 2024 Proxy Statement | | | 3

| | | |

TABLE OF CONTENTS Internet Availability of Proxy Materials Under U.S. Securities and Exchange Commission (“SEC”) rules, we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. The Notice of Internet Availability mailed to our stockholders contains instructions on Form 10-K for the year ended December 31, 2020 (“2020how to access our proxy materials, including our proxy statement and our 2023 Annual Report”).Report. The Notice of Internet Availability also instructs you on how to access your proxy card to vote through the Internet or by telephone. This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the annual meeting and help conserve natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise. ATTENDING

THE 2021 ANNUAL MEETINGAttending the 2024 Annual Meeting | | | | | | |

LIVE WEBCAST | Live webcast available at

www.virtualshareholdermeeting.com/MELI2021

| | WEBCAST STARTS | | | REPLAY |

www.virtualshareholdermeeting.com/MELI2024 | Webcast starts

| | at 12:1:00 p.m., June 8, 20215, 2024 Eastern Time | | | available until June 5, 2025 |

Questions | | FOR QUESTIONS REGARDING: | | | YOU MAY CONTACT: | |

| Replay available

until June 8, 2022

|

QUESTIONS

| | | | | | | | | | For questions

regarding:

| | You may

contact:

| | | | 20212024 Annual Meeting

| | | MercadoLibre Investor Relations, by going to http:

https://investor.mercadolibre.com/contact-uscontact-ir/ and submitting your question or request | | | | | Voting Stock Ownership

|

| | Computershare Overnight Mail Delivery: 462 South 4th Street, Suite 1600,

Louisville, KY, 40202, USA

Regular Mail: PO BOX 505000, Louisville, KY, 40233-5000,43078, Providence, RI, 02940-3078, USA | | | | |

|

Courier Delivery: 150 Royall St., Suite 101, Canton, MA 02021

888 313 1478 (U.S. investors) | |

+1 (201) 680 6578 (Non-U.S. investors)

www.computershare.com/investor

| |

As of the date of this proxy statement, our board does not know of any matters to be presented at the 2024 Annual Meeting other than those specifically set forth in the Notice of 2024 Annual Meeting of Stockholders and this proxy statement. If other proper matters, however, should come before the 2024 Annual Meeting or any adjournment thereof, the proxies named in the enclosed proxy card intend to vote the shares represented by them in accordance with their best judgment in respect of any such matters. | | | | | 4 | www.computershare.com/investor

| | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTS | Letter from our Chairman and Chief Executive Officer |

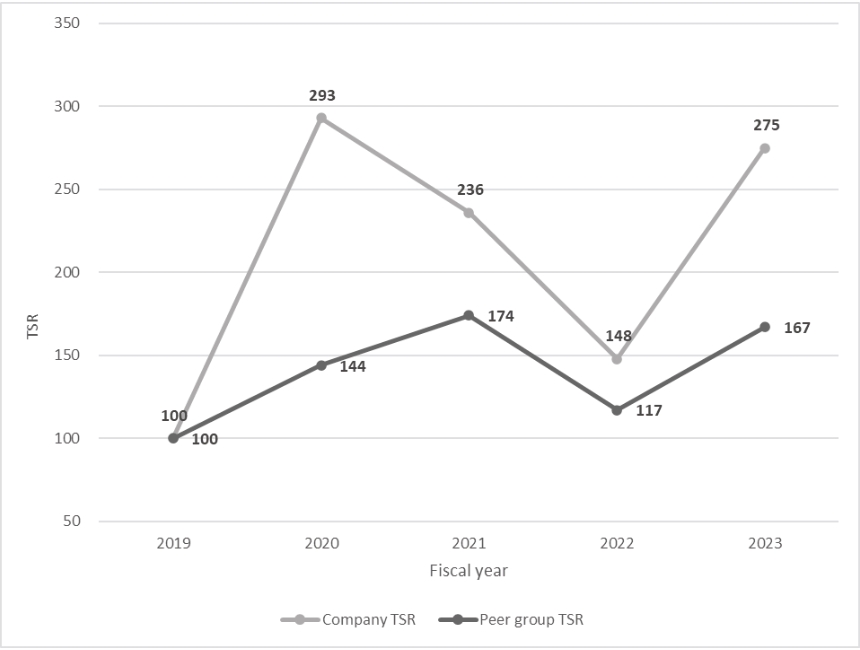

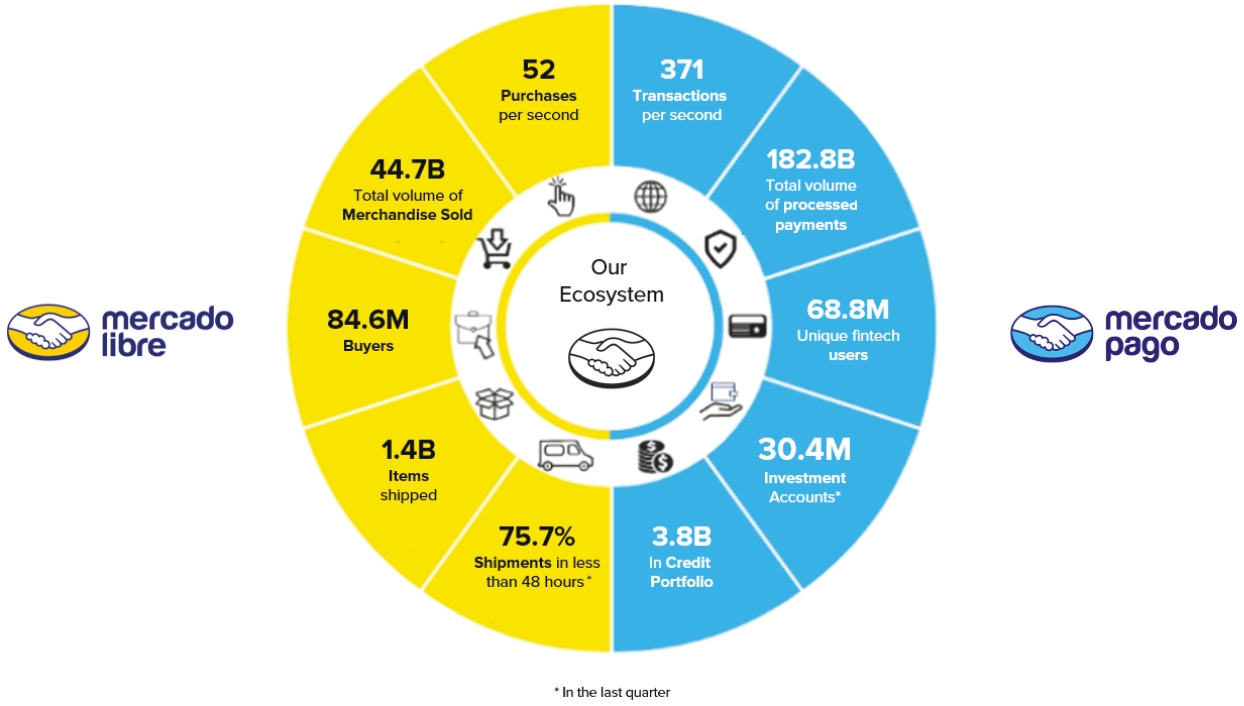

Compounding is a concept that is familiar to investors, and the returns generated for shareholders by MercadoLibre are a good example of this concept at work. Compounding is also a good way to look at the investments we have been making in technology and product development over many years. These investments drive innovation and, over time, a significant number of these innovations compound into a fantastic and constantly improving user experience. This is reflected in the growth of the number of people that choose the MercadoLibre Marketplace as their platform to buy or sell goods, and Mercado Pago as the platform to manage their finances. In 2023, unique active buyers1 reached 85 million, growing at their fastest rate (15% year over year) since 2020, whilst Fintech monthly active users2 showed even more impressive growth of 32% year over year at the end of 2023. These are foundations that will support our future growth. We operate in a region that has significant growth opportunities; Latin America has a combined population of more than 650 million and a GDP of more than $6 trillion. This leaves considerable room for growth as we continue to scale our user base. We believe that we are uniquely positioned to capitalize on these growth opportunities as the region's leading e-commerce platform and one of its leading fintechs. Core to achieving this is building competitive advantages through investment in technology and this continues to be one of our guiding principles. On behalf of the board of directors, I would like to express our appreciation for your continued interest in MercadoLibre. We look forward to your attendance at the 2024 Annual Meeting of Stockholders or receiving your proxy vote. Sincerely yours,

Marcos Galperin

Chairman of the Board, President

and Chief Executive Officer | |

1

| Unique active buyers is defined as users that have performed at least one purchase on the Mercado Libre Marketplace during the reported period. |

2

| Fintech Monthly Active Users: defined as Fintech payers and/or collectors as of March 31, 2024, that, during the last month of the reporting period, performed at least one of the following actions during such month: 1) made a debit or credit card payment, 2) made a QR code payment, 3) made an off-platform online payment using our checkout or link of payment solutions while logged in to our Mercado Pago fintech platform, 4) made an investment or employed any of our savings solutions, 5) purchased an insurance policy, 6) took out a loan through our Mercado Credito solution, or 7) received the payment from a sale or transaction either on or off marketplace. |

| | | MercadoLibre 2021 2024 Proxy Statement | 6

| | 5

| | | |

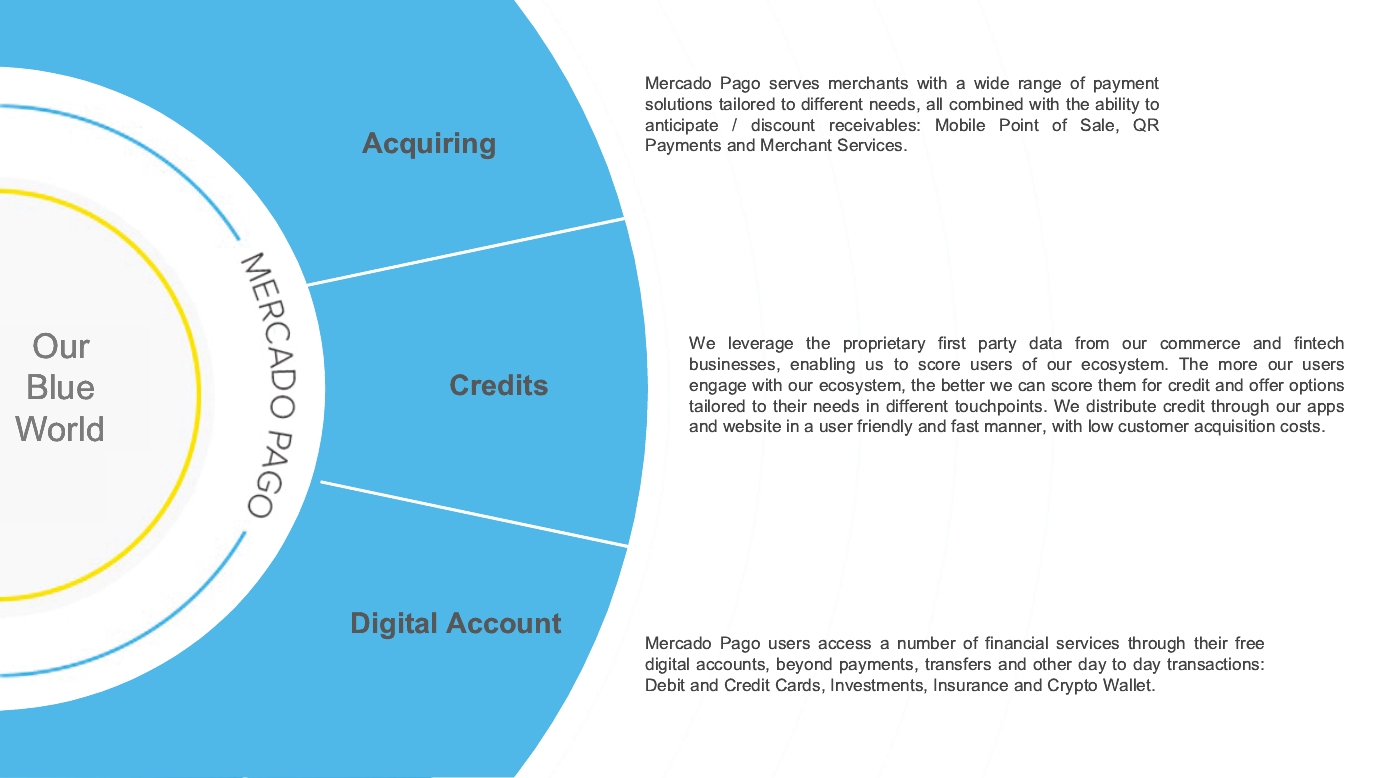

TABLE OF CONTENTS An Ecosystem for

Consumers and Merchants Our Company & Our Mission MercadoLibre is the largest online commerce ecosystem in Latin America based on unique visitors and orders processed. In addition to Commerce, MercadoLibre also offers a wide array of financial services through the MercadoPago Fintech business. We are present in 18 countries. Our platform is designed to provide users - both consumers and merchants - with a complete portfolio of services to facilitate commercial transactions both digitally and offline, with the purpose of democratizing commerce and financial services across Latin America. Through its platforms, MercadoLibre provides its users with robust online commerce and digital financial tools that not only contribute to the development of a large and growing ecommerce community in Latin America, but also foster entrepreneurship, social mobility and financial inclusion. We offer our users an ecosystem of integrated e-commerce and digital financial services: | | | 6 | | | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTSQUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR 2021

ANNUAL MEETING

| An Ecosystem for Consumers and Merchants | | | |

| | | MercadoLibre 2024 Proxy Statement | | | 7

| | | |

TABLE OF CONTENTS | An Ecosystem for Consumers and Merchants | | | |

Forward-Looking Statements Any statements herein regarding MercadoLibre, Inc. that are not historical or current facts are forward-looking statements. These forward-looking statements convey MercadoLibre, Inc.’s current expectations or forecasts of future events. Forward-looking statements regarding MercadoLibre, Inc. include, but are not limited to, statements regarding MercadoLibre, Inc.’s expectations, objectives and progress against strategic priorities, initiatives and strategies related to our products and services, business and market outlook, opportunities, strategies and trends, impacts of foreign exchange, the potential impact of the uncertain macroeconomic and geopolitical environment on our financial results, customer demand and market expansion, our planned product and services releases and capabilities, industry growth rates, future stock repurchases, our expected tax rate and tax strategies, the impact and result of pending legal, administrative and tax proceedings, and other factors that may cause MercadoLibre, Inc.’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk Factors,” and “Special Note Regarding Forward-Looking Statements” sections of MercadoLibre, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023, and any of MercadoLibre, Inc.’s other applicable filings with the Securities and Exchange Commission. Unless required by law, MercadoLibre, Inc. undertakes no obligation to publicly update or revise any forward-looking statements to reflect circumstances or events after the date hereof. | | | 8 | | | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTS IMPACT HIGHLIGHTS

We act today for sustainable development in Latin America We are entrepreneurs who know that sustainability is a path of continuous improvement,

with many challenges ahead but with a clear focus: the time to act is now. |

| Why am I receiving these materials?

| Our board

At MercadoLibre, we believe that sustainability involves every area of directorsour business. It is providing these proxy materialsa commitment that we renew every day, every time we take risks to you in connection withinnovate, achieve scale and generate a transformational impact.

We believe that fast pace growth enables us to foster and enhance the positive socioeconomic impacts of our board’s solicitationbusiness, driving commercial and financial inclusion, and contributing to the prosperity of proxies for use at our 2021 Annual Meeting that will take place on June 8, 2021. Stockholders are invitedcommunities. It also requires us to attendbe increasingly efficient and innovative to reduce the 2021 Annual Meeting and are requested to voteenvironmental impact throughout the value chain. We focus on the proposals describedbest we can do today to continue to grow responsibly. It is a path of continuous, collective improvement, and one with many challenges ahead in such a dynamic and exponential industry. But our focus remains clear: the time to act is now.

Under this proxy statement.premise, our strategy has three main focus areas of action: |

| | | Socioeconomic

development and

inclusion | | | | | | Social Empowerment | | | | | | Environmental

Strategy and

Innovation |

| What information is containedWe promote enterprises and triple-impact brands within our ecosystem, helping their commercial development and providing visibility, specifically in these materials?

| The information included in this proxy statement relates to the proposals to be voted on at the 2021 Annual Meeting, the voting process, the compensation of our directors and our named executive officers and certain other required information.

| | |

| Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

| In accordance with SEC rules, we may furnish proxy materials, including this proxy statement and our 2020 Annual Report, which includes our audited consolidated financial statements for the year ended December 31, 2020, to our stockholders by providing access to these documents on the Internet instead of mailing printed copies. Onsegments where geographical distance or about April 29, 2021, we first mailed to our stockholders (other than those who previously requested electronicdigital, gender or paper delivery) a Notice of Internet Availability containing instructions on howracial factors make it harder to access our proxyplatforms. We also aim to drive female entrepreneurship through education and financial inclusion, addressing two of the major hurdles that persist for female entrepreneurs when scaling their businesses. Our solutions ecosystem is a key factor for the digital inclusion of social organizations, as well as boosting their ability to raise funds.

| | | We want to broaden access not just to the solutions on our platform, but also to the science and technological industry in general, by providing individuals with thousands of opportunities to study, do business or work. We believe that the best way to democratize these opportunities is through education, and we therefore seek to bring a wide array of educational content to thousands of young people in the region, enabling them to develop skills and imagine possible futures in the broad universe of technology, in collaboration with their peers. | | | We recognize that our growth creates its own environmental challenges. We aim to own up to this tension, concentrating on the best we can do today in order to grow sustainably. Measuring our carbon footprint enables us to identify the key impacts of our operations and their value chain. Our environmental strategy to reduce our carbon footprint is based on sustainable mobility, energy management and material circularity, in addition to the regeneration and conservation of Latin America’s iconic biomes. |

| And only by attracting, engaging and developing the best talent can we uphold this purpose. We are a diverse team looking to make an impact following ethical values that define the way we act. |

| | | MercadoLibre 2024 Proxy Statement | | | 9

| | | |

TABLE OF CONTENTS | | | Socioeconomic development and inclusion

|

| True to our origins, our mission is to democratize commerce and financial services in Latin America. We are committed to that mission by expanding our reach to include more and more people every day, creating development opportunities for entrepreneurs and organizations across the region, and contributing to the progress and prosperity of our communities. |

Positive-Impact consumption (Argentina, Brazil, Chile, Colombia, Mexico and Uruguay)

In 2019, we created the “Sustainable Products” section on our Mercado Libre Marketplace platform to promote brands and entrepreneurs that contribute to reducing environmental impact and generating positive social impacts, democratizing access to products that benefit people and the environment and promote a new economy. We seek to be a one-stop shop for the most positive-impact products in the market, promoting responsible and conscious consumption. To boost the offer of positive-impact products, we provide sales training courses for triple impact and socio-biodiversity enterprises and hold visibility campaigns for their products. And, to maximize demand, we inform users of the existing research relating to online positive-impact consumption trends and are transparent in our communication of product selection criteria.

■ Over 930k unique publications of positive-impact products.

■ +67,000 positive-impact brands and entrepreneurs. | | | Users purchased products

(+27% over 2022)

Products sold,

57%+ vs 2022 | | | | |

Biomas: products in support of socio-biodiversity ( (Mexico, Brazil and Argentina)

The “Biomas in a Click” program was created to help communities that contribute to biodiversity preservation through the sustainable production of items gain access to new markets to improve income generation, and to distribute their products and knowledge across the region. In this way, we promote fair commerce and income generation for thousands of families who support biome preservation where they live. The program offers entrepreneurs from the biomes training in sales, business strategy, logistics, and digital marketing, individual and group mentorship by MercadoLibre specialists and allied foundations, and highlighted visibility in the Sustainable Products section and their own landing page to promote their products.

Our contributions were recognized by Reuters Events Sustainable Business in the “Biodiversity Champion Award” category, for promoting entrepreneurial actions that integrate biome conservation with regional development and the promotion of the bioeconomy.

■ +34,000 local producers indirectly benefited.

■ +47,600 products sold.

■ 8 iconic Latin American biomes represented. | | | Supported Organizations

| | | | |

| | | 10 | | | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTS Afro-lab Program (Brazil)

Since 2018, we have been partnering with Preta Hub to support businesses led by Black entrepreneurs in Brazil, contributing to their digital inclusion and income generation, and the promotion of Black entrepreneurship, culture and creativity.

To this end, we place our tools and know-how about online sales strategies at the disposal of participants of Afrolab, an initiative for the acceleration of black entrepreneurs led by Preta Hub. We showcase their stories and products on our platform through an official, exclusive Feira Preta store and promotion and cultural appreciation campaigns. | | | Black entrepreneurs received training in Brazil

products sold by the official Feira Preta store on MercadoLibre | | | | | |

Empowering women entrepreneurs

In spite of being promoters of the economy and generators of employment, women entrepreneurs in Latin America face the most barriers to financial management services and tools, which are key to the formalization and growth of their businesses.

We know that education is a key factor enabling other dimensions of financial inclusion, such as financial wellbeing and productive development. Mercado Pago has partnered with Pro Mujer, in Spanish speaking Latin America, and with Aliança Empreendedora and Barkus, in Brazil, to improve the financial education of women entrepreneurs in the region. The initiative is focused on boosting their income-generation capacity and helping them plan a sustainable future for their business. In this way, participants gain access to educational content at each stage of their enterprise, acquire digital skills for leadership, personal development, finance and sales, connect with other women entrepreneurs in the region, and receive advice and personalized support. The program accompanies them throughout the development cycle of their business, and through it we seek to create a network of women entrepreneurs in Latin America.

■ 64% improved their financial skills.

■ 86% adopted the use of budgeting in their businesses.

■ 85% report to have incorporated digital channels and/or online payment solutions into their businesses. | | | certified entrepreneurial women

(+5,000 since the start of the program in 2022) |

| | | MercadoLibre 2024 Proxy Statement | | | 11

| | | |

TABLE OF CONTENTS | | | Social empowerment: Education for digital inclusion |

Education to democratize knowledge and opportunities

We want people to be able to take advantage of the thousands of possibilities for studying, starting businesses or working offered by the science and technology industry, and we know that education is the best way to democratize these opportunities.

| | We are acting today to promote more inclusive development in Latin America. |

Beta Hub(Argentina, Brazil, Chile, Uruguay, Colombia and Mexico)

In 2023, we launched Beta Hub, a learning community aimed at encouraging teenagers in Latin America to use technology to change their world.

Beta Hub offers free training and content to young people ages 16 to 18, and an interactive space where teenagers are challenged to progress from being users to becoming creators of technology-based solutions. The community provides a connection with specialists, leaders in the area and peers with similar interests, providing them with tools and inspiring them to make their ideas a reality.

We support this community by partnering with education and technology organizations in Latin America that share our views on diversity and inclusion. | | | young people registered on the platform

scholarships granted

young people graduated (65% of the graduates were able to learn more about technology and identify what they want to study) |

Conectadas (Argentina, Mexico, Brazil, Peru, Colombia, Chile and Uruguay)

Our program “Conectadas”, which seeks to bring more girls and young women to technology, celebrated its third anniversary in 2023. The program is an immersive, online, free-of-charge initiative targeting 14 to 18-year-old women, aimed at providing them with tools and contact with positive references in the world of technology, to develop their self-confidence and to empower them to create solutions for the challenges they identify in the region.

■ 145 impact projects ideas originated by participants.

■ 84% of the young women participating in the program discovered that they enjoy studying, researching and working on technology issues. | | | Young women between 14 and 18 years of age from seven countries in Latin America participated in the program | | | | |

| | | 12 | | | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTS Certified TECH Developer (Argentina, Brazil, Chile, Uruguay, Colombia, Mexico, Peru and Ecuador)

In 2021 we teamed up with Globant and Digital House to co-create the Certified Tech Developer program, an initiative that grants scholarships to young people to pursue technology careers in Argentina, Chile, Colombia, Uruguay, Brazil and, starting in 2023, in Mexico, Peru and Ecuador.

■ 1,100 scholarships awarded.

■ 45% of the scholarships were awarded to women.

| | | Students have completed the program since 2021 |

| | | Growing in a sustainable way |

Carbon footprint

Our environmental strategy is based on a continuous improvement process that supports our sustainable growth. A central part of this strategy is measuring our carbon footprint, allowing us to identify and implement reduction actions with agility.

Since 2016, we believe we have been measuring our footprint with increasingly accurate indicators. This enables us to monitor our impact, allowing us to anticipate specific actions targeting our operations and value chain.

We measure emissions using internationally recognized methods such as the Greenhouses Gas (GHG) Protocol, the Global Logistics Emissions Counsel (GLEC) Framework, and others by the Department for Environment Food and Rural Affairs (DEFRA), the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC). Each year we seek to improve the calculation, making it more accurate and compatible with the reality of our business. | | | 0.00014tn of CO2e per US$ invoiced revenues

(Scopes 1, 2 and 3)

of CO2e per buyer

(Scopes 1, 2 and 3) |

| | | MercadoLibre 2024 Proxy Statement | | | 13

| | | |

TABLE OF CONTENTS Carbon Footprint Management – Our Environmental Impact Strategy

Energy Efficiency Renewable Energies

■ Smart metering strategy that allows us to remotely monitor our consumption through the use of smart sensors and real-time dashboards.

■ As of the end of 2023, more than 100 distribution centers with smart metering in Argentina, Chile, Colombia, Brazil and Mexico.

■ Continuing the process of migrating 100% of our operations to renewable energy sources.

■ In 2023, 13 MercadoLibre distribution centers migrated to 100% renewable energy, reaching a total of 29 sites between centers and offices.

■ Launched our first onsite solar photovoltaic plant in Colombia with more than 1,000 panels, reaching 3 sites with onsite generation in the region.

■ Approximately 44% of our total energy consumption was of renewable energy sources, which represent a total of 63,375 MWh.

Sustainable Mobility

We engage the entire logistics chain in the challenge of achieving sustainable mobility based on low-emission fuels.

In 2023, 2,321 electric vehicles were used for deliveries through our partner carriers in Brazil, Mexico, Colombia, Chile, Uruguay and Argentina. This type of transport lets us cut up to 90% of carbon emissions for deliveries compared to similar diesel vehicles, depending on the country of operation. As added value, electric vehicles are less noisy, which improves the quality of life in cities.

Another effective way of cutting emissions from our logistics is to use low-emission or renewably-sourced fuels. We have therefore encouraged our partner carriers to invest in developing a fleet of 169 trucks running on natural gas (a fuel that emits around 18% less carbon than diesel) and biomethane, a fuel made from organic waste, that has the potential to significantly reduce emissions in comparison with diesel.

Innovation to speed up low-carbon logistics

We have partnered with Newlab, a US-based innovation laboratory, that encourages collaboration between entrepreneurs, scientists and engineers to develop cutting-edge technologies. We carried out a collaborative study with this organization to explore and integrate emerging logistics technologies with low carbon emissions sourced from worldwide enterprises and new companies.

In 2023, we issued an invitation to startups around the world working on sustainable mobility, and received replies from 128 organizations, 62% of them in Latin America.

Sustainable Packaging & Materials

The entire logistics, technological and support operation for buying and selling on our e-commerce platform, and transporting items generates waste. This waste represents 1.11% of our carbon footprint. We seek solutions for minimizing the volume of materials includingsent to landfills and for reinserting it in the productive cycle, thus encouraging the circularity of materials. We are working on three fronts: reduce, substitute and recycle, as well as making people in our proxy statementvalue chain aware of the issue. | | |

Of our total energy consumption

comes from renewable energy

resources

New sites migrated to renewable

energy

Packages delivered by sustainable

mobility fleet

electric vehicles

+191.2% vs. 2022 |

| | | 14 | | | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTS We ensure that every shipment has the optimum packaging to protect both the product and the environment. In connection with that, we analyze size, materials and recyclability. We also use technology and creativity to find solutions to give users a better experience while reducing the environmental impact. Our distribution centers have a smart solution that measures the volume of each item to define the ideal package size and ensure safety without wasting material. 100% of the packaging of the products leaving our distribution centers is recyclable, reusable or compostable. We ensure the circularity of materials by encouraging the use of recycled content in our packaging. At the same time, since 2020, we have promoted the shipping of certain products in their primary packaging, without further packaging. In this way, we contribute to the reduction of packaging materials, optimize space and, in turn, reduce the fuel used for transport. In 2023, this form of shipment continued to grow, reaching 15% of products.

| | | MercadoLibre 2024 Proxy Statement | | | 15

| | | |

TABLE OF CONTENTS Regeneration

In March 2021, we launched “Regenera America” a program that seeks to contribute to the regeneration and conservation of the region's emblematic natural ecosystems. We believe that by doing so, we contribute to capturing carbon, essential to mitigating the progression of the climate crisis, and to preserving biodiversity.

To develop the program, we have already invested $23.7 million. These funds were allocated among nine projects in Brazil and México, to restore and conserve a total of 14,587 hectares.

We focused on Latin America because it is home to around 40% of the planet’s biodiversity. We started with the Atlantic Forest because it is one of the most threatened ecosystems in the region, known for its important watersheds, and because Brazil is home to our largest operation. | | | Invested so far to develop

“Regenera America”

Hectares of land in restoration and conservation

tons of CO2 capture in a 30 year-

horizon

tons of avoided CO2 emissions in a 30 year-horizon since launch |

A team in constant beta mode

Only by attracting, engaging and developing the best talent can we lead in every market where we operate and uphold our purpose. Each year we evolve to stay ahead and respond to challenges more quickly. This is why we say that being constantly in beta mode is part of our culture. We are continually assessing our practices and our 2020 Annual Report. The Noticevalue proposition to design the best experience and enable our employees to fulfill their potential.

Although we operate in a challenging context, at Mercado Libre, we have continued with our plans for growth. In 2023, we have grown into a team exceeding 58,000 people.

In 2023, we focused on strengthening our technology and logistics talent to promote growth; designing work dynamics that respond to our training and adapt to any context; developing leaders and broadening our work practices to become a more diverse company. All of Internet Availability also instructs youthese efforts are aimed at gaining efficiency and continuing to grow sustainably. | | | people on howthe Mercado Libre team in

2023

|

| | | 16 | | | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTS Inclusion and equal opportunities

We consider inclusion to access your proxy cardbe a competitive advantage, a source of innovation for us to votecontinue being disruptive. This is why we are constantly working to broaden our perspectives and include different outlooks in our team.

Our Diversity, Equity and Inclusion strategy is based on three complimentary pillars that reinforce each other:

Build Diverse Teams

We seek complementarity through different profiles to create innovative products that connect and reflect the Internet,diversity of our users.

Every open position is an opportunity to introduce a new way of thinking, a unique person who complements a current member of our team. This helps us be more innovative and develop enhanced products that address the needs and expectations of millions of different users.

Historically our focus has been on five action fronts: women, people with disabilities, ethnicity, LGBTQIAP+, and from 2023, different generations.

Develop Inclusive Environments

We promote respectful workspaces where differences are valued, by telephone or by mail. You will not receive printed copies ensuring equal opportunities and that everyone is heard and can express themselves, share opinions, propose ideas for innovating and challenge their team with new perspectives. We try to eliminate bias and make leadership roles a multiplier factor in the creation of a diverse and inclusive culture. We encourage open, collaborative dialogue with Affinity Groups, which are communities consisting of members prepared to willingly give their time, knowledge and ideas to accelerate our agenda of Diversity, Equity and Inclusion.

Promote an Inclusive Society

Promoting inclusive products and services and equal opportunities. | | | women in IT (17% in senior leadership positions)

of our team belongs to the LGBTQIAP+ community

of the proxy materials unless you request them. Instead, the Noticeemployees see their leaders as promoters of Internet Availability will instruct you as to how you may accessinclusive and reviewdiverse environments |

| | | MercadoLibre 2024 Proxy Statement | | | 17

| | | |

TABLE OF CONTENTS | | | Ethics and Transparency |

| | | Transparency and

Integrity

flow in

our DNA | We demand that all of the proxy materials on the Internet. If you would like to receive a paper or electronic copypeople who work at MercadoLibre and those who are part of our proxy materials, including a copy of our 2020 Annual Report, you should follow the instructions in the Notice of Internet Availability for requesting these materials. | | |

| How do I get electronic access to the proxy materials?

| | The Notice of Internet Availability will provide you with instructions regarding how to:

| | | | view our proxy materials for the 2021 Annual Meeting on the Internet; and

| | instruct us to send our future proxy materials to you electronically by e-mail.

| | Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

| | |

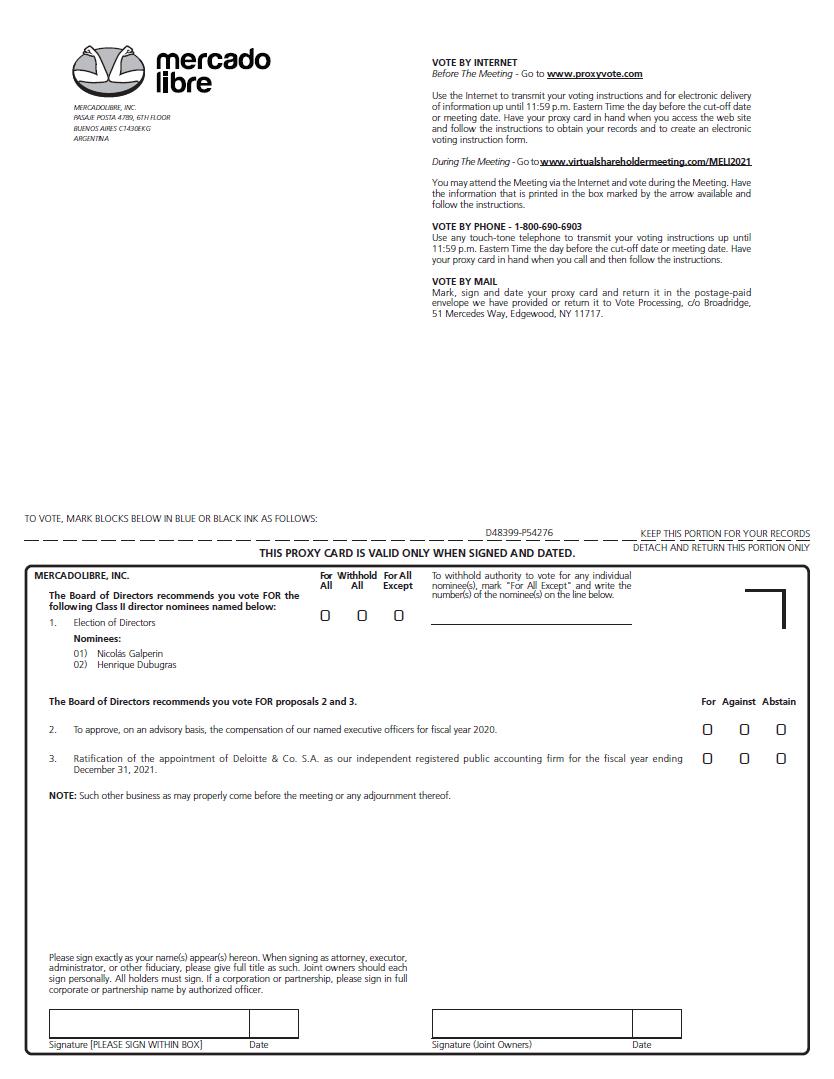

| What proposals will be voted on at the 2021 Annual Meeting?

| | There are three proposals scheduled for a vote at the 2021 Annual Meeting:

| | | | the election of the two Class II directors nominated and recommended by our board, each to serve until the 2024 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified;

| | the approval, on an advisory basis, of the compensation of our named executive officers for fiscal year 2020; and

| | the ratification of the appointment of Deloitte & Co. S.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

|

| | MercadoLibre 2021 Proxy Statement

| 7

|

| What are our board’s voting recommendations?

| | Our board recommends that you vote your shares:

| | | | “FOR” the election of the two Class II directors nominated and recommended by our board;

| | “FOR” the approval, on an advisory basis, of the compensation of our named executive officers for fiscal year 2020; and

| | “FOR” the ratification of the appointment of Deloitte & Co. S.A. as our independent registered public accounting firm for 2021.

| | |

| How many shares are entitled to vote?

| Each share of our common stock outstanding as of the close of business on April 12, 2021, the record date, is entitled to one vote at the 2021 Annual Meeting. At the close of business on April 12, 2021, 49,852,319 shares of our common stock were outstanding and entitled to vote. You may vote all of the shares owned by you as of the close of business on the record date and each share of common stock held by you on the record date represents one vote. These shares include shares that are (1) held of record directly in your name and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee.

| | |

| What is the difference between holding shares as a stockholder of record and as a beneficial owner?

| Most stockholders of MercadoLibre hold their shares beneficially through a stockbroker, bank or other nominee rather than directly in their own name. There are some distinctions between shares held of record and shares owned beneficially, specifically:

Shares held of record

If your shares are registered directly in your name with our transfer agent, Computershare, you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to us. If you requested to receive printed proxy materials, we have enclosed or sent a proxy card for you to use. Each stockholder of record is entitled to vote by proxy as described in the Notice of Internet Availability and below.

Shares held in brokerage account or by a bank

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and the Notice of Internet Availability was forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or other nominee on how to vote the shares in your account.

| | |

| Can I attend the 2021 Annual Meeting?

| You are invited to participate in the 2021 Annual Meeting if you are a stockholder of record or a beneficial owner at the close of business on April 12, 2021. Any stockholder can attend the 2021 Annual Meeting via the Internet at www.virtualshareholdermeeting.com/MELI2021. We encourage you to access the Annual Meeting online prior to its start time. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://investor.mercadolibre.com.

|

| | MercadoLibre 2021 Proxy Statement

| 8

|

| |

| How can I vote my shares?

| | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may vote as follows:

| | | | If you are a stockholder of record, you may vote by proxy over the Internet or by telephone by following the instructions provided in the Notice of Internet Availability, or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card. You may also attend the Annual Meeting at 12:00 p.m., Eastern Time, on June 8, 2021 via the Internet at www.virtualshareholdermeeting.com/MELI2021 and vote during the Annual Meeting using the control number we have provided to you

| | If you hold shares beneficially in street name, you may also vote by proxy over the Internet or by telephone by following the instructions provided in the Notice of Internet Availability, or, if you requested to receive printed proxy materials, you can also vote by mail by following the voting instruction card provided to you by your broker, bank, trustee or nominee.

| | Under Delaware law, votes cast by Internet or telephone have the same effect as votes cast by submitting a written proxy card.

|

| Can I change my vote or revoke my proxy?

| | If you are the stockholder of record, you may change your proxy instructions or revoke your proxy at any time before your proxy is voted at the 2021 Annual Meeting. Proxies may be revoked by any of the following actions:

| | | filing a timely written notice of revocation with our Corporate Secretary at our principal executive office (Pasaje Posta 4789, 6th Floor, Buenos Aires, Argentina, C1430EKG);

| | granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method); or

| | attending the 2021 Annual Meeting online and voting via the Internet using the control number we have provided to you (attendance at the meeting will not, by itself, revoke a proxy).

| | If your shares are held through a brokerage account or by a bank or other nominee, you may change your vote by:

| | | | submitting new voting instructions to your broker, bank or nominee following the instructions they provided; or

| | if you have obtained a legal proxy from your broker, bank or nominee giving you the right to vote your shares, by attending the 2021 Annual Meeting and voting in person.

| | |

| How are votes counted?

| Election of two Class II Directors. In the election of two Class II directors, you may vote “for” any or all of the nominees for Class II directors or you may “withhold” your vote with respect to any or all of the nominees for Class II director. Only votes “for” will be counted in determining whether a plurality has been cast in favor of a nominee for Class II director.

| Advisory Vote to Approve our Named Executive Officers’ Compensation for 2020. In the approval, on an advisory basis, of the compensation of our named executive officers for fiscal year 2020, you may vote “for,” “against” or “abstain.” If you elect to abstain from voting, the abstention will have the same effect as a vote against this proposal.

| Ratification of Appointment of Independent Auditor. In the proposal to ratify the appointment of our independent registered public accounting firm for 2021, you may vote “for,” “against” or “abstain.” If you abstain from voting, it will have the same effect as a vote against this proposal.

|

| | MercadoLibre 2021 Proxy Statement

| 9

|

| No cumulative voting rights are authorized, and dissenter’s rights are not applicable to these matters.

| If you sign and return your proxy card or broker voting instruction card without giving specific voting instructions, your shares will be voted “FOR” the election of the two Class II directors nominated and recommended by our board and named in this proxy statement, “FOR” approval of the compensation of our named executive officers, “FOR” the ratification of the approval of our independent auditors, and at the discretion of the proxies in any other matters properly brought before the 2021 Annual Meeting.

| If you are a beneficial holder and do not return a voting instruction card, your broker is only authorized to vote on the ratification of the approval of our independent auditors. See “What are broker non-votes and what effect do they have on the proposals?”

| | |

| Who will count the votes?

| A representative of Broadridge will tabulate the votes at the 2021 Annual Meeting and act as the inspector of elections.

| | |

| What is the quorum requirement for the 2021 Annual Meeting?

| The quorum requirement for holding the 2021 Annual Meeting and transacting business is a majority of the outstanding shares entitled to vote. The shares may be present in person or represented by proxy at the 2021 Annual Meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum.

|

| |

| What is the voting requirement to approve each of the proposals?

| Election of two Class II Directors. The Class II directors will be elected by a plurality of the votes of the shares present in person or by means of remote communication or represented by proxy and entitled to vote on the matter, meaning that the two Class II director nominees receiving the highest number of “FOR” votes will be elected.

| Advisory Vote to Approve our Named Executive Officers’ Executive Compensation for 2020. The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the matter is required to approve our named executive officers’ compensation for fiscal year 2020. This vote is advisory and will not be binding on the Company, the board of directors perform their duties under the highest ethical and conduct standards, and we expect all suppliers, customers, and business partners to comply with these same standards.

In 2023, we launched our new Code of Ethics, now known as the “MELI Code,” which applies to all of our employees and directors, subsidiaries or affiliates across the compensation committee.

| Ratification of Appointment of Independent Auditor.different countries in which we operate and, where applicable, suppliers, customers and business partners. The voteMELI Code is a guide to help make daily decisions in the context of a majoritycomplex work environment, encouraging our employees to put MercadoLibre’s cultural principles into practice, with particular focus on responsibility and ethical commitment. The MELI Code synthesizes the attributes that are part of our DNA: honesty, transparency and integrity.

The MELI Code also codifies an integrated system of existing internal policies and procedures. We have procedures in place to review and ensure prompt compliance with the MELI Code and the policies and procedures described therein. See, for example, the section of the shares present in person or represented by proxy is required to ratify the appointmentMELI Code titled “Ever-present channels,” which encourages anonymous reporting of our independent registered public accounting firm for 2021.

|

| | MercadoLibre 2021 Proxy Statement

| 10

|

| What are broker non-votes and what effect do they have on the proposals?

| Generally, broker non-votes occur when shares held by a broker, bank or other nominee in “street name” for a beneficial owner are not voted with respect to a particular proposal because (1) the broker, bank or other nominee has not received voting instructions from the beneficial owner and (2) the broker, bank or other nominee lacks discretionary voting power to vote those shares. A broker, bank or other nominee is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares, but is not entitled to vote shares held for a beneficial owner on any non-routine matter without instruction from the beneficial owner. The ratificationpotential violations of the appointmentMELI Code through our Whistleblower Hotline. When situations of our independent registered public accounting firm is consideredsignificant non-compliance are detected, they are reported to be a routine matter for which brokers, banks or other nominees holding shares in street name may exercise discretionary voting power in the absenceEthics Committee (composed of voting instructions from the beneficial owner. As a result, broker non-votes will not arise in connectionCompany’s Corporate Affairs Head (Chairman), Chief Financial Officer, General Counsel, People Head and Risk and Compliance Head).

Every person working at MercadoLibre has to acknowledge compliance with and thus will have no effect on, this proposal.Unlike the proposal to ratify the appointment of our independent auditors, the election of directorsMELI Code and the advisory vote on our named executive officers’ compensation for fiscal year 2020 are each considered a “non-routine” matter. As a result, brokers, banks or other nominees holding shares in street name that have not received voting instructions from their clients cannot vote on their clients’ behalf on these proposals. Therefore, it is very important that you provide your broker, bank or other nominee who is holding your shares in street name with voting instructions with respect to these proposals in onemain policies of the manners set forth in this proxy statement. Under Delaware law, broker non-votes that arise in connectionEthics & Compliance department upon joining the organization. Also, all third parties providing services on behalf of or for the benefit of MercadoLibre before public officials or governmental agencies must acknowledge compliance with the election of directors or the advisory vote on our named executive officers’ compensation for fiscal year 2020 will have no effect on these proposals.

| | |

| Where can I find the voting results of the 2021 Annual Meeting?

| We will announce final voting resultsMELI Code.

The MELI Code is periodically reviewed in a current report on Form 8-K that will be filedaccordance with the SEC within four business days after the 2021 Annual Meetingapplicable regulatory trends and that will also bebest practices.

The MELI Code is publicly available on our investor relations website at http://investor.mercadolibre.com.Investor Relations site. | | | |

| Who will bear the cost of soliciting votes for the 2021 Annual Meeting?

| We will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for any Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities.

|

To learn more about MercadoLibre’s impact and sustainability efforts see our Impact Report, which is available on our website: https://investor.mercadolibre.com/sustainability/. We have also published our Sustainability Bond report, which is available on our investor relations website: https://investor.mercadolibre.com/sustainability/. Links to websites or reports included in this proxy statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this proxy statement or incorporated herein or into any of our other filings with the SEC. | | | 18 | | | MercadoLibre 2024 Proxy Statement | | | |

Election of

Directors PROPOSAL ONE:

ELECTION OF TWO CLASS II DIRECTORSOur certificate of incorporation provides for our board to be divided into three classes, with each class having a three-year term. In accordance with our certificate of incorporation and bylaws, the number of directors that constitutes our board of directors is fixed from time to time by a resolution duly adopted by our board. Our board currently consists of eightnine members. Information as to the directors currently comprising each class of directors and the current term expiration date of each class of directors is set forth in the following table: | | DIRECTORS COMPRISING CLASS | | | CLASS | | | CURRENT TERM EXPIRATION DATE | | Class

| Directors Comprising Class

| Current Term Expiration Date

| Class I

| Susan Segal | 2023 Annual Meeting

| |

Mario Eduardo Vázquez | | |

Alejandro Nicolás Aguzin | | | Class I | | | 2026 Annual Meeting | | | | Nicolás Galperin

Henrique Dubugras

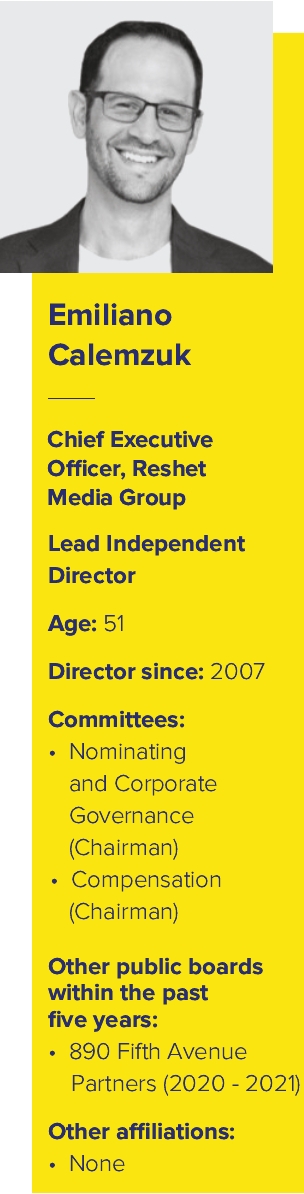

Richard Sanders | | | Class II | | | 2024 Annual Meeting | | | Emiliano Calemzuk

Marcos Galperin

Andrea Mayumi Petroni Merhy | | | Class IIIII | Nicolás Galperin

| 2021

| 2025 Annual Meeting | | Meyer Malka

| | | | | Class III

| Emiliano Calemzuk

| 2022 Annual Meeting

| | Marcos Galperin

| | | Roberto Balls Sallouti

| |

A director elected to fill a vacancy (including a vacancy created by an increase in the size of our board) will serve for the remainder of the term of the class of directors in which the vacancy occurred and until his or her successor is elected and qualified, or until his or her earlier death, resignation or removal. As discussed in greater detail below in “Information on our Board of Directors—Directors and Corporate Governance — Director Independence and Family Relationships,”Relationships” our board has determined that sixseven of the eightnine current members of our board are independent directors within the meaning of the listing standards of The NASDAQ Global Select Market (the “NASDAQ”“NASDAQ”) and our corporate governance guidelines.The terms of our twothree Class II directors are set to expire at the 20212024 Annual Meeting. The nominating and corporate governance committee recommended, and our board nominated, each of Nicolás Galperin, Henrique Dubugras and Richard Sanders as nomineenominees for re-election as a Class II director of our Company. Mr. Malka has chosen to not run for re-election to serve on the Board of Directors. Mr. Malka is relinquishing his position at the end of his current term, which coincides with the date of the Annual Meeting. Mr. Malka has served on the Board of Directors since 2013, providing years of valuable contributions to the Company. Mr. Malka’s decision not to stand for re-election to the Board was not based on any disagreement with the Company with respect to any matter relating to the Company’s operations, policies or practices. The nominating and corporate governance committee recommended, and our board nominated Henrique Dubugras as nominee for election as a Class II directordirectors of our Company at the 20212024 Annual Meeting. If elected at the 20212024 Annual Meeting, each of the Class II director nominees will serve until our 20242027 Annual Meeting of Stockholders and until his successor is duly elected and qualified, or until his earlier death, resignation or removal. If any of the nominees is unexpectedly unavailable for election, shares represented by validly delivered proxies will be voted for the election of a substitute nominee proposed by our nominating and corporate governance committee or our board may determine to reduce the size of our board. Each person nominated for election has agreed to serve if elected. Set forth below is biographical information for the nominees, as well as the key attributes, experience and skills that the board believes each nominee brings to the board.

| | | MercadoLibre 2024 Proxy Statement | | | 19

| | | |

TABLE OF CONTENTS Process for Director Nominations Nominating and Corporate Governance Committee. The nominating and corporate governance committee of our board performs the functions of a nominating committee. The nominating and corporate governance committee’s charter describes the committee’s responsibilities, including identifying, reviewing, evaluating and recommending director candidates for nomination by our board. Our corporate governance guidelines also contain information concerning the responsibilities of the nominating and corporate governance committee with respect to identifying and evaluating director candidates. Both documents are published on our investor relations website at http://investor.mercadolibre.com. Director Candidate Recommendations and Nominations by Stockholders. The nominating and corporate governance committee’s charter provides that the committee will consider director candidates recommended by stockholders. The charter of the nominating and corporate governance committee also provides that it will evaluate all candidates for election to our board, regardless of the source from which the candidate was first identified, based on the totality of the merits of each candidate and not based upon minimum qualifications or attributes. Stockholders should submit any such recommendations for the consideration of our nominating and corporate governance committee through the method described under “Stockholder Communications with our Board” below. In addition, any stockholder of record entitled to vote for the election of directors may nominate persons for election to our board if that stockholder complies with the notice procedures summarized in “Stockholder Proposals for 2025 Annual Meeting” of this proxy statement. Process for Identifying and Evaluating Director Candidates. The nominating and corporate governance committee evaluates all director candidates in accordance with the criteria described in our corporate governance guidelines and the nominating and corporate governance committee charter. The committee evaluates any candidate’s qualifications to serve as a member of our board based on the skills and characteristics of individual board members as well as the composition of our board as a whole. In addition, the nominating and corporate governance committee will evaluate a candidate’s independence, skills, experience, reputation, integrity, potential for conflicts of interest and other appropriate qualities in the context of our board’s needs. Director diversity. We do not have a formal policy about diversity of our board membership, but the nominating and corporate governance committee charter requires that the committee consider, when assessing the desired composition of our board, factors such as integrity, strength of character, judgment, business experience, specific areas of expertise, ability to devote sufficient time to attendance at and preparation for board meetings, factors relating to the composition of the board (including its size and structure) and principles of diversity. Our corporate governance guidelines provide that, given the regional and complex nature of our business, the board believes it is important for the nominating and corporate governance committee to also consider diversity of race, ethnicity, gender, age, education, skill, cultural background and professional experience. However, the nominating and corporate governance committee neither includes nor excludes any candidate from consideration solely based on the candidate’s diversity traits. See “Diversity Matrix” for information about the diversity matrix of our board. | | | 20 | | | MercadoLibre 2021 2024 Proxy Statement | 12

| | |

as Class II DirectorsClass II Directors

Director| | |

| Experience:

| | Nicolás Galperin

CAREER HIGHLIGHTS:

Mr. Galperin worked at Morgan Stanley & Co. Incorporated, an investment bank, from 1994 to 2006, and his last position was managing director and head of trading and risk management for the London emerging markets trading desk, as well as a trader of high-yieldhigh yield bonds, emerging markets bonds and derivatives in New York and London. In 2006, Mr. Galperin founded Onslow Capital Management Limited, an investment management company that was based in London, and worked at the company until its closure in 2018. Mr. Galperin is now an investor based in London. He graduated with honors from the Wharton School of the University of Pennsylvania. Mr. Galperin is the brother of Marcos Galperin, our chairman, president and chief executive officer.Key Attributes and Skills:

KEY ATTRIBUTES AND SKILLS:

Entrepreneurship: Mr Galperin brings to the board his entrepreneurial experience as founder of Onslow Capital Management Limited.

Finance:Mr. Galperin’s career in investment banking and investment management, including including serving in various leadership roles at Morgan Stanley and Onslow Capital Management, provides valuable business experience and critical insights on the roles of finance and strategic transactions in our business. His

Risk Oversight: Mr. Galperin’s particular focus on emerging capital markets throughout his career and his leadership in risk management contribute key skills to our board. Based

LatAm and Other Markets: Mr. Galperin is based in London Mr. Galperinand has focused his investment banking and investment management career in emerging markets, which brings experience withto our board valuable global business perspective and knowledge of both Latin American and European businesses. In addition to this global business perspective, Mr. Galperin’s extensivemarkets.

Banking: Extensive experience in banking and investments, includeswhich resulted in an understanding of financial statements, corporate finance, accounting and capital markets and fixed income products and derivatives.

Private Equity: Mr. Galperin's professional background includes 20 years of experience investing in the private equity space. | Nicolás Galperin, 52

| Director since: 1999

| MercadoLibre, Inc.’s

Board Committees:

None

|

| | | MercadoLibre 2024 Proxy Statement | | | 21

| | | |

TABLE OF CONTENTS | Proposal I | | MercadoLibre 2021 Proxy Statement

| 13

| |

| |

| Experience:

Henrique Dubugras

CAREER HIGHLIGHTS:

Mr. Dubugras is the co-founder & co-CEO of Brex Inc. Brex Inc. is a company reimagining financial systems so every growing company can realize their full potential and take control of their spend and business as they scale. Prior to that position, Mr. Dubugras co-founded Pagre.me,Pagar.me, an online payments company, EduqueMe, an educational crowdfunding company aimed at sponsoring Latin American students in United States colleges, and Estudar nos EUA, a company aimed at disseminating information and opportunities related to studying abroad for both undergraduate and graduate level students. From September 2016 to March 2017 he studied computer science at Stanford University.Key Attributes and Skills:

KEY ATTRIBUTES AND SKILLS:

Finance:Mr. Dubugras brings a deep understanding of financial tools and services that provide critical insights to our business.

Entrepreneurship: Mr. Dubugras’ experience with innovation in the start-upstartup space promisesmakes him uniquely positioned to introduce new andcontribute creative ideas for our growth and place in an evolving world.

Industry Experience (Fintech): Mr. Dubugras has a wealth of technical and non-technical expertise in the financial services business along with knowledge of various financial services ecosystems. Our board believes that his experience with online payment systems, coupled with his transnational professional network, make him an asset to our Company. | Henrique

LatAm Markets: As co-founder of Pagar.me, an online payment company that operates in Brazil, Mr. Dubugras 25MercadoLibre, Inc.’s

Board Committees:

None

| | brings valuable knowledge and understanding of the Brazilian market. | |

| | | 22 | | | MercadoLibre 2024 Proxy Statement | | | |

TABLE OF CONTENTS |

| | | Richard Sanders

CAREER HIGHLIGHTS:

Mr. Sanders is a partner at Permira, a global private equity firm. Mr. Sanders is a member of Permira’s Executive Committee and Investment Committees for their Flagship and Growth Opportunities funds, and until 2023 was the co-head of the technology sector investment team. Mr. Sanders joined Permira in 1999 and has spent most of his career based in London. He relocated to the United States between 2007 and 2011 to set up Permira’s office in Menlo Park, California. Prior to joining Permira, Mr. Sanders worked for Morgan Stanley in London in the M&A and High Yield Capital Markets divisions. Mr. Sanders holds an M.A. in Literae Humaniories (Classics) from Oxford University and an M.B.A from Stanford University where he was a Fulbright Scholar.

KEY ATTRIBUTES AND SKILLS:

Innovation & Technology: Mr. Sanders has a vast experience with making investment decisions in technology and digital markets industries and, therefore, brings a deep understanding of those industries.

Industry Experience (Commerce): His experience as director of Allegro.eu provides an invaluable viewpoint and knowledge to our board when assessing matters related to our Company’s business and strategy and the challenges and opportunities that lie ahead.

Private Equity: 25 years of experience at a global private equity firm.

Finance: Mr. Sanders professional background has given him extensive financial and M&A transactional skills, as well as exposure to dealing with large institutional investors globally.

Risk Oversight: Extensive experience as director of other companies in the oversight and management of risks.

Management: Valuable management and leadership skills, as member of a senior leadership team of Permira. | |

| | THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION

ABOVEABOVE. | |

| | | MercadoLibre 2024 Proxy Statement | | | 23

| | | |

TABLE OF CONTENTS | | MercadoLibre 2021 Proxy Statement

| 14

Information on our Board of Directors and Corporate Governance |

INFORMATION ON OUR BOARD OFDIRECTORS AND CORPORATE

GOVERNANCE

Our business is managed by our employees under the direction and oversight of our board. Except for our chief executive officer, none of the members of our board is an employee of MercadoLibre. Our board members remain informed of our business through discussions with management, materials we provide to them, and their participation on the board and in board committee meetings.

We believe open, effective, and accountable corporate governance practices are key to our relationship with our stockholders. Our board has adopted corporate governance guidelines that, along with the charters of our board committees and our code of business conduct and ethics, provide the framework for the governance of our Company. A complete copy of our corporate governance guidelines, the charters of our board committees, and our code of business conduct and ethics may be found on our investor relations website at http://investor.mercadolibre.com. Information contained on or connected to our website is not part of this proxy statement. The board regularly reviews corporate governance developments and modifies these policies as warranted. Any changes in these governance documents will be reflected in the same location of our website.

| | MercadoLibre 2021 Proxy Statement

| 15

|

Board of Directors The following is biographical information on the remainder of our continuing directors, as well as the key attributes, experience and skills that the board believes such continuing directors bring to the board. Class

CLASS I DirectorsDIRECTORS | | |

| Experience:

Ms. Segal has been president and chief executive officer of the Americas Society and Council of the Americas since August 2003, after having worked in the private sector for more than 30 years. Prior to her current position, Ms. Segal was a founding partner of her own investment advisory firm focused primarily on Latin America and the U.S. Hispanic market. Previously, she was a partner and Latin American Group Head at JPMorgan Partners/Chase Capital Partners, where she pioneered early stage venture capital investing in Latin America. Prior to joining Chase Capital Partners, Ms. Segal was a senior managing director focused on Emerging Markets Investment Banking and Capital Markets at Chase Bank and its predecessor banks. She was actively involved in developing investment banking, building an emerging-market bond-trading unit for Latin America and was also involved in the Latin American debt crisis of the 1980s and early 1990s both chairing and sitting on various advisory committees. Ms. Segal is on the Board of Directors of Scotiabank, where she serves on the Audit and Risk Committees. Additionally, she is a director and chairperson of Scotiabank USA, a non-public subsidiary of Scotiabank. She also serves as a director of the Tinker Foundation, the Bretton Woods Committee and is a member of the Council of Foreign Relations. She is also a Board member of Vista Oil and Gas, S.A.B. de C.V. and Ribbit Leap, Ltd. In 1999, she was awarded the Order of Bernardo O’Higgins Grado de Gran Oficial in Chile and in 2009 President Uribe of Colombia honored her with the Cruz de San Carlos. In 2012, she was awarded the Order of the Mexican Aztec Eagle in Mexico and in 2019 she was awarded Peru’s Order of “Merit for Distinguished Services” in the rank of Grand Official. Ms. Segal received a master’s in business administration from Columbia University and a bachelor’s degree from Sarah Lawrence College. Ms. Segal previously served as a director of our Company from 1999 to 2002.

Key Attributes and Skills:

Ms. Segal’s impressive experience includes her background studying the economies of Latin American countries. She is also well-versed in Latin America’s prospects for growth, integration, and economic and social development, and she is knowledgeable about economic inclusion, social empowerment, markets, overall business environment, diversity issues and risk assessment. Her background includes experience in trade, finance, private equity, venture capital, social media, and infrastructure. Ms. Segal’s decades of experience in Latin America have enabled her to create an extensive network among Latin America’s political and business leaders. Given the increasing political and other challenges involved with doing business across national borders in Latin America, the board believes that Ms. Segal’s prior experience and extensive knowledge of these affairs qualify her to serve as a director of our Company.

| Susan Segal, 68

| Director since: 2012

| MercadoLibre, Inc.’s

Board Committees:

| Audit Committee

Compensation

Committee

(effective as of the

Annual Meeting)

|

| | | MercadoLibre 2021 Proxy Statement

| 16

|

| |

| Experience:

Mr.Mario Eduardo Vázquez serves as a member of the board of directors and as the president of the audit committee of Globant S.A. (NYSE: GLOB) and Despegar.com, Corp, and as President of the compensation committee and corporate governance and nominating committee of Globant S.A.

CAREER HIGHLIGHTS:

Mr. Vázquez served as the chief executive officer of Grupo Telefónica in Argentina from June 2003 to November 2006, and served as a member of the board of directors of Telefónica S.A. Spain from November 2000 to November 2006. He has also served as a regular member of the board of directors of Telefónica Argentina S.A. and Telefónica Holding Argentina S.A., and as alternate member of the board of directors of Telefónica de Chile S.A until 2012. Mr. Vázquez served as a member of the board of directors of YPF S.A. and as the president of the Audit Committee of YPF S.A until 2012. Since November 2006, Mr. Vázquez has pursued personal interests in addition to his service as a director. Mr. Vázquez spent 23 years as a partner and general director of Arthur Andersen for Argentina, Chile, Uruguay and Paraguay (Pistrelli, Diaz y Asociados and Andersen Consulting—Accenture), where he served for a total of 33 years until his retirement in 1993. Mr. Vázquez previously taught as a professor of Auditing at the Economics School of the University of Buenos Aires. Mr. Vázquez received a degree in accounting from the University of Buenos Aires.Key Attributes and Skills:

KEY ATTRIBUTES AND SKILLS:

Finance: Mr. Vázquez was chosen to join our board specifically to serve our audit committee as its audit committee financial expert. We targeted a director with financial and auditing experience specific to Latin American businesses. Mr. Vázquez worked in auditing for Arthur Andersen for 33 years total, including 23 years as a partner and general director, in many of our markets, including Argentina, Chile, Uruguay and Paraguay. He also brings an academic perspective to the position from his time as a professor of Auditing at the Economics School of the University of Buenos Aires. Finally, Mr. Vázquez has employed these skills

Innovation & Technology: Extensive experience as a board member of several other technology and other companies, thuswhich adds a valuable perspective and insight to our board.

LatAm Markets: Mr. Vázquez served as an auditor for Arthur Andersen for 33 years total, including 23 years as a partner and general director, in many Latin American markets, including Argentina, Chile, Uruguay and Paraguay. | |